Easily Invest in Online Businesses

Invest in multiple online businesses and watch your money grow

11.8%

Cash Yield

20%+

Annualized IRR

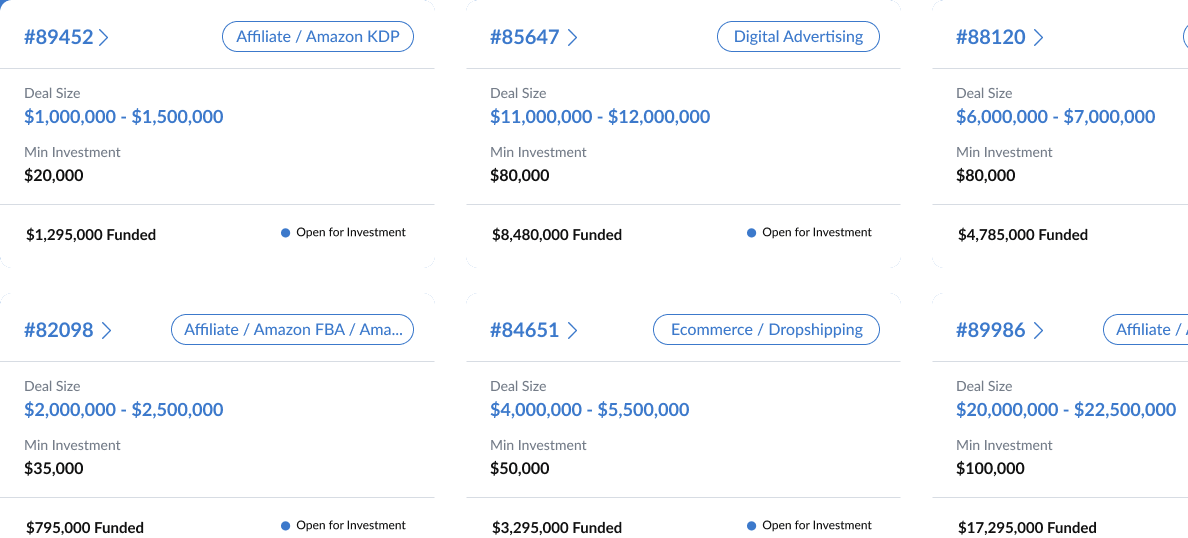

WebStreet curates a diversified fund of Portfolio Managers based on their track record of acquiring and managing online businesses.

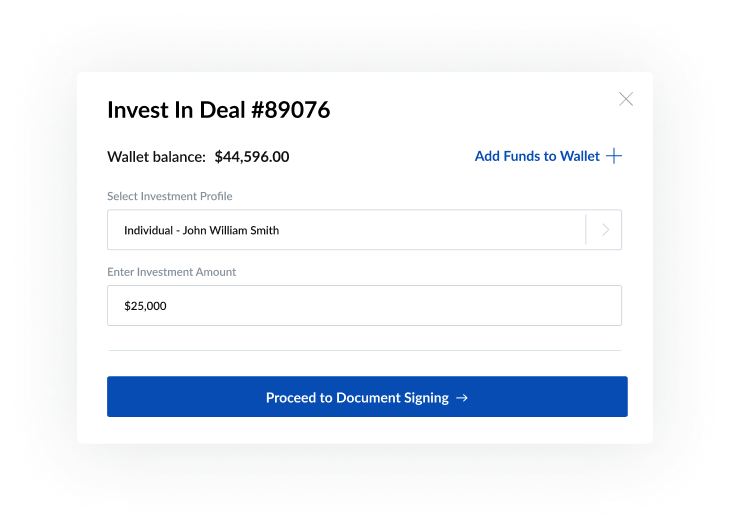

Follow the steps to complete accreditation, sign legal documents & transfer your funds.

Once funds are invested, you will own a fractional piece of each business you invest in & receive quarterly distributions.

Accredited investors who want exposure to online businesses but may not have the time or skill set

Entrepreneurs and Founders who may have the skill but want passive returns and diversification

Non-accredited investors or those who don’t have the capacity to take on the risk or diversify across multiple funds.

Active investors looking to run their own online business

| Investor Profile | Accredited Investors |

| Minimum Investment | $60,000 USD |

| Capital Stack | 95% Investor Capital 5% Portfolio Manager Capital |

| Profit Split & Carried Interest | 66.7% to Investors • 20% to Portfolio Managers |

| Operating Profit Distribution Schedule | Paid Quarterly. Split at the percentages above First distribution 9-12 months after investment |

| Sale of Business Distribution Schedule | Investors recoup their initial investment first Increase in business value is split at the percentages above |

| Hold Period | 2-4 years |

| Return Expectations | 20% projected average annual returns* |

| Reporting | Quarterly reports including financials and commentary. Financials are put together by a 3rd party accounting firm and reviewed by WebStreet |

* These are estimated returns which may be significantly higher or lower. There is no cap or guarantee on returns, and investments may result in partial or total loss. Please refer to legal fund documents for full detail of terms.

Assets Acquired

40

Raised Amount

$36M+

Projected IRR*

20%+

Past performance is no guarantee of future results and any expected returns on investment disclosed through the investor platform are hypothetical and may not reflect actual future performance. All investments made through the investor platform may result in partial or total loss. All fund performance information disclosed through the Investor Platform is presented prior to the removal of all management fees and expenses unless otherwise disclosed. Some of the statements made on the Investor Platform constitute forward-looking statements and should not be relied upon as predictors of future events. These statements may fail to account for both known and unknown risks, market or other uncertainty, changes in the economy as a whole, or changes outside of the control of the portfolio manager.

Nothing contained within the Investor Platform or the Services should be considered investment advice and you should obtain investment and tax advice from independent investment professionals prior to investing in any offering provided through the Investor Platform or the Services. All information provided through the Investor Platform and the Services, including information in private placement memorandums, have been prepared without knowledge of or concern for each Investor’s individual financial situation or risk tolerance.

Nothing contained within the Investor Platform or the Services should be considered to constitute tax, legal, or investment advice.

The official SEC criteria for accredited investors is outlined below.

Income can be from any source including your own business. The only exception is income from your primary residence.

Absolutely. As long as investors meet the accreditation requirements as laid out by the SEC they will be able to invest.

There will be no additional capital calls for investors, meaning you’ll never be required to contribute additional funds into any deal.

Investors will receive a quarterly report covering their investments with financials and written commentary. Financials are put together by a 3rd party accounting firm, who have direct access to the monetizations and bank accounts. They will pull the numbers and put the reports together. WebStreet will audit the reports for any questions or anything unusual and ask the portfolio manager to explain in detail. Portfolio managers will put together commentary on the performance of their portfolio, what happened in the last quarter and their plan for the coming quarter.

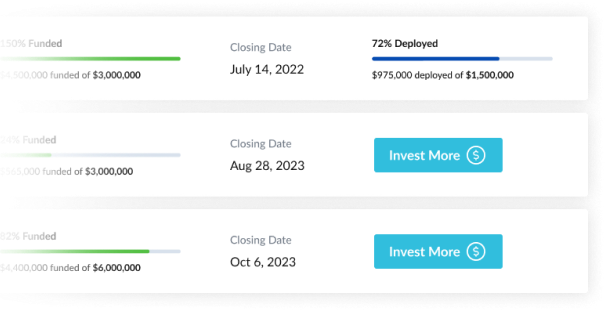

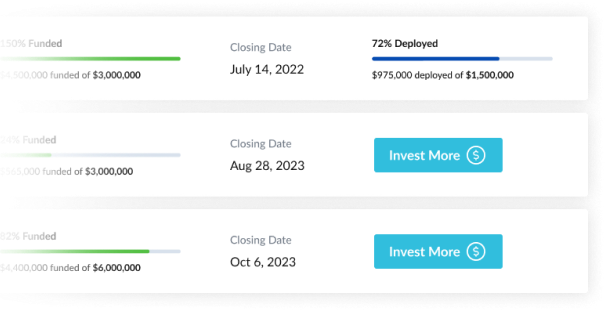

During the fundraising period, WebStreet raises funds from investors on behalf of the prescribed portfolio managers for the current fund. All investment funds are held in a segregated account. After the fundraising period, the portfolio managers enter a 90 day acquisition period when they can make offers and acquire assets. WebStreet ensures that funds are only deployed to purchase assets that match the portfolio managers’ predetermined criteria.

Note: If the money is not deployed within 90 days from the acquisition of full funding, it will be refunded to the investors. If the portfolio managers deploy less than the amount raised (including money set aside for growth) the difference will be refunded to investors proportionally.

The portfolio managers will acquire assets that match their acquisition criteria and growth plans. Once the funds are deployed and the businesses have been acquired, the portfolio managers may reinvest some of the monthly profits into growth. Some portfolio managers may set aside some of the raised money to be used for growth, and if they do, the amount will vary for each portfolio and will be outlined on the individual portfolio page.

Each fund is a separate legal entity consisting of several portfolios of assets, each run by it’s respective portfolio manager. Raised funds are deployed on the most promising assets which meet the portfolio managers’ strategies, and held within the fund until exit.

Portfolio managers and investors own the LP equivalent to the cash they put in (95% Investors, 5% Portfolio Manager). The Portfolio Managers, WebStreet and Advisors receive an additional carried interest based on the profits but no additional ownership.

Each LP is a passthrough entity. You will get a K-1 that shows the income of the LP and your percentage ownership. Any income and any eligible depreciation will pass through. Please consult with your tax accountant for planning advice.

Yes, the setup is standard. If you’re a non-American and have invested internationally it will be exactly the same. Tax withholding on non-American companies is 21%. Tax withholding on foreign individuals is 37%. Please note that foreign trusts are taxed at the individual rate of 37% as well.

The US has tax treaties with many other countries so you should not be double taxed even if they withhold a higher amount you may be able to file a tax return and claim some of it back. Please consult with your tax accountant for planning advice.

Apart from investing your capital and choosing which Funds you want to be part of, this investment will be completely passive. You will not have access to the portfolio managers to ask questions or give input on how to run the business. You will simply receive a quarterly report and a quarterly distribution for each fund you invest in.

Please fill out our portfolio manager interest form (PM Interest Form) including your experience, strategy, current and past portfolio performance. We will inform you of our vetting process and be in touch to discuss next steps. Please wait to hear back from us after you submit your form.

It is critical for WebStreet to get the best portfolio managers involved in the program. We are diligent in vetting our portfolio managers and making sure they’re qualified.

When we first started EF Capital, we had one goal in mind: to create a win-win business that would find common ground between experienced online business portfolio managers and accredited investors.

Initially, we had little choice but to incubate the business under the Empire Flippers brand. Establishing a fund without a track record is an uphill battle. Being de-facto pioneers in this alternative investment segment made it even more challenging.

Empire Flippers operates as a broker. It attracts clients who want to showcase the quality of their business and sell it at the best possible fair value. Although EF Capital eventually sells businesses, it first has to buy them and wants to do so at the lowest price possible to maximize returns for its investors.

While we mitigated that by using external advisors, we still knew that, eventually, we would need a clean split as we will have to work with other brokers. Regardless of Empire Flipper’s leading position, not all online businesses are sold there. Our duty to investors is to find the best fit for the proposed strategy at the best price, wherever that is.

As such, we are excited to announce that we have completed our rebranding process and are now WebStreet!

Although it wasn’t an easy process, we felt that this was the right next step in our journey to providing exposure to this asset class for the mainstreet investor.

We remain committed to the highest standards of excellence as the best place to invest in quality online businesses, with a plan to gradually scale up to our goal of deploying $150 million in funds per year while delivering excellent returns.

Check out the FAQ section of the website or contact us.