Online Business Investing for RIAs

Speak with our Investor Relations Manager to learn more

11.8%

Cash Yield

20%+

Annualized IRR

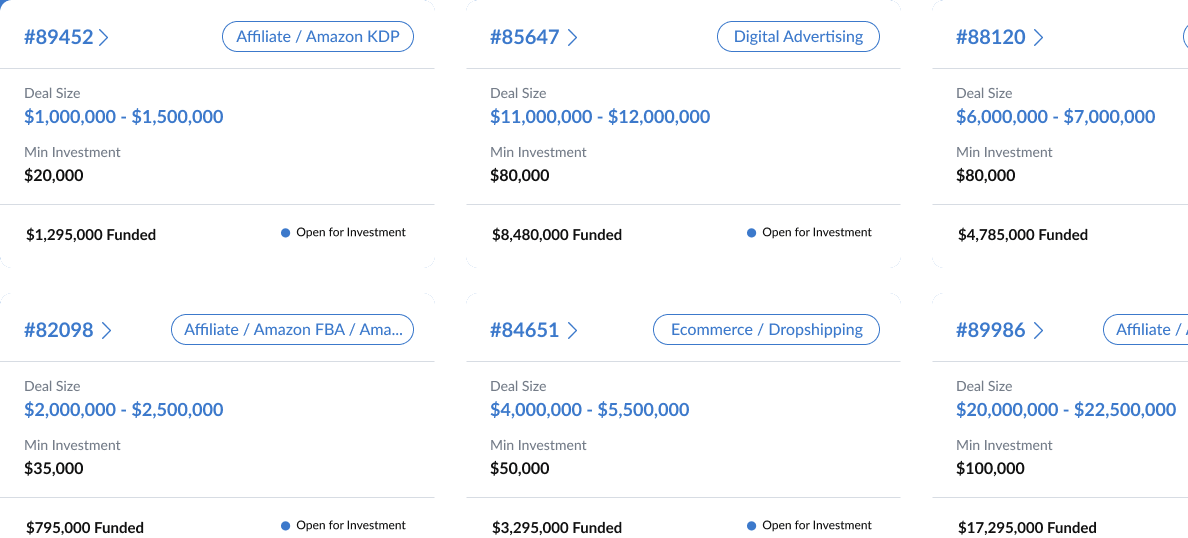

WebStreet curates a diversified fund of Portfolio Managers based on their track record of acquiring and managing online businesses.

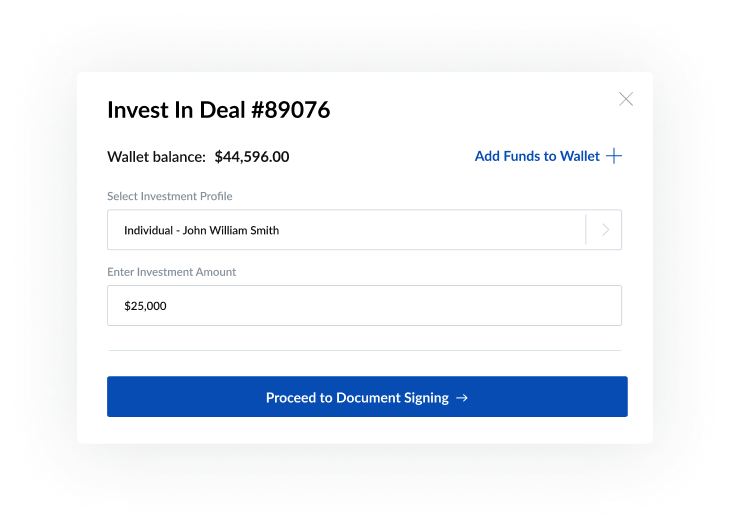

Follow the steps to complete accreditation, sign legal documents & transfer your funds.

Once funds are invested, you will own a fractional piece of each business you invest in & receive quarterly distributions.

Accredited investors who want exposure to online businesses but may not have the time or skill set

Entrepreneurs and Founders who may have the skill but want passive returns and diversification

Non-accredited investors or those who don’t have the capacity to take on the risk or diversify across multiple funds.

Active investors looking to run their own online business

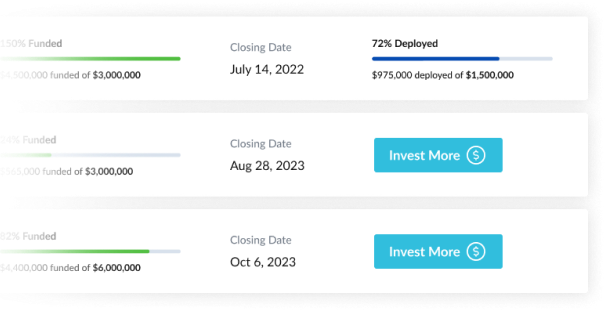

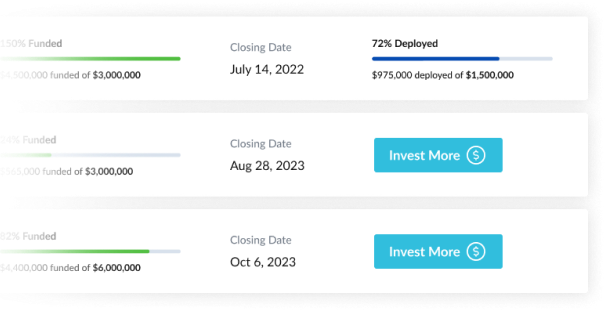

| Investor Profile | Accredited Investors |

| Minimum Investment | $60,000 USD |

| Capital Stack | 95% Investor Capital 5% Portfolio Manager Capital |

| Profit Split & Carried Interest | 66.7% to Investors • 20% to Portfolio Managers |

| Operating Profit Distribution Schedule | Paid Quarterly. Split at the percentages above First distribution 9-12 months after investment |

| Sale of Business Distribution Schedule | Investors recoup their initial investment first Increase in business value is split at the percentages above |

| Hold Period | 2-4 years |

| Return Expectations | 20% projected average annual returns* |

| Reporting | Quarterly reports including financials and commentary. Financials will be put together by a 3rd party accounting firm and reviewed by WebStreet |

* These are estimated returns which may be significantly higher or lower. There is no cap or guarantee on returns, and investments may result in partial or total loss. Please refer to legal fund documents for full detail of terms.

Assets Acquired

40

Raised Amount

$36M+

Projected IRR*

20%+