WebStreet – Raising the Bar in 2022

WebStreet (formerly EF Capital) is a first-of-its-kind fund that allows accredited investors to invest in high-quality online businesses fractionally. These passive illiquid investments yield quarterly cash flows and have a projected return of 20% annually over the investment round cycle (4-6 years).

An old Wall Street proverb states that there is always a bull market somewhere. Still, the stock and bond markets declined simultaneously for the first time in decades – due to one of the steepest rises in interest rates, and even traditional hedges like gold or real estate produced negative returns.

Those bull markets proved elusive. Existing, but visible only to those resilient enough to venture beyond the average investors’ operating view.

Such investors make WebStreet’s inner circle. After raising $13 million in 2021, the fund raised over $10 million in 2022. While online businesses are one of the best-kept secrets of alternative investments, they will not stay below the radar at this pace for long.

To fully capitalize on those growth prospects, EF Capital has finalized the split from Empire Flippers by rebranding as Webstreet. To finance that endeavor, the company raised $2.8 million from investors who received preferred equity shares. This funding will cover the original loan from Empire Flippers and allow for further growth, with a target of deploying $100 million per year within two to three years. This capital will solidify Webstreet’s position as a leader in this growing industry while ensuring that the company scales efficiently.

By rebranding as Webstreet, the company will have access to other marketplaces and a wider range of opportunities, allowing it to reach its target of $100 million in annual turnover without any potential conflicts of interest.

WebStreet Performance Update for Q4 2022

Total funds deployed by WebStreet amount to $18.5 million from over 275 investors across three rounds, 11 funds, and nine portfolio managers who acquired 25 unique online businesses. Round 3 funds are underway, with the first distributions expected shortly.

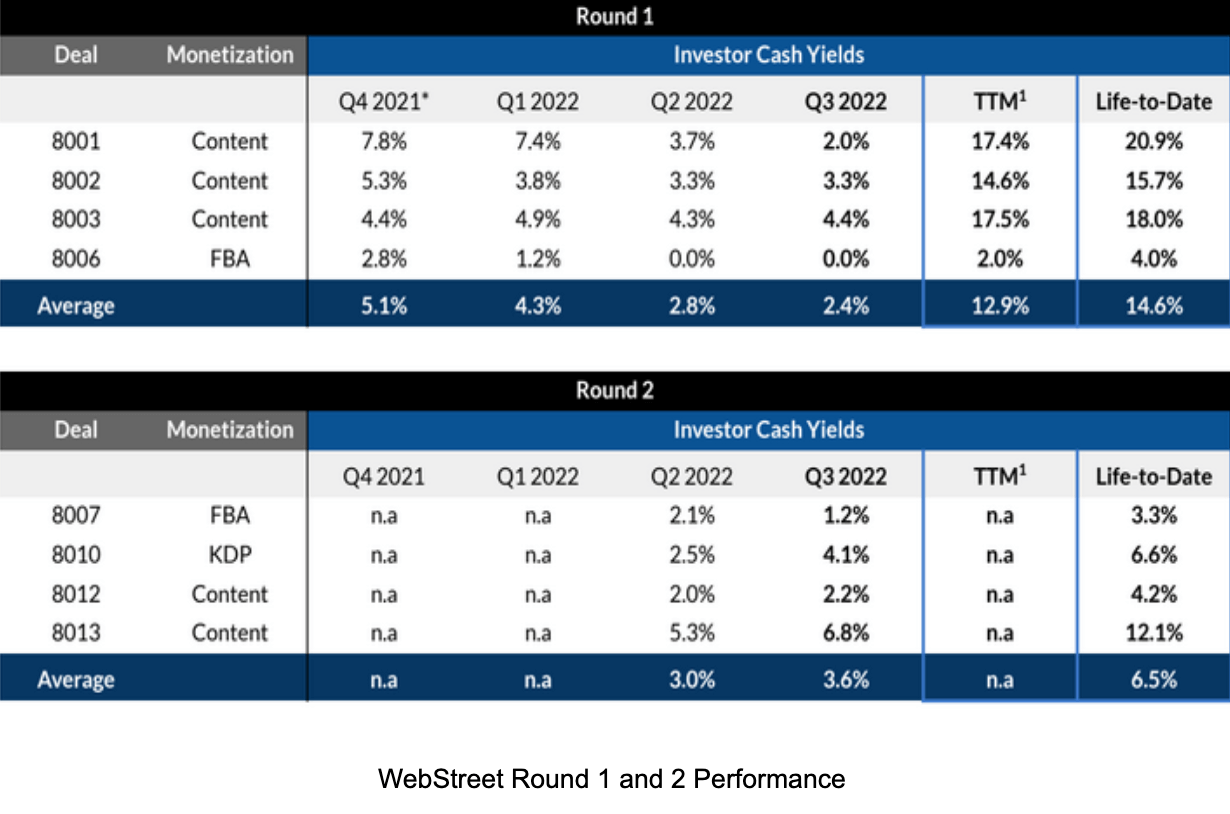

Here are the numbers for Rounds 1 and 2.

From the funds closed in Rounds 1 and 2, it’s clear that content businesses are dominating returns. While Amazon FBA remains one of the most popular online business models, it is worth noting that its returns are heavily back-loaded because a significant portion of funds goes into inventory and growth capital that will pay off in the future. Furthermore, seasonality affects many of these businesses. Therefore, future reports will focus on a trailing 12-month average as a more meaningful gauge after more data is obtained.

We expect these businesses to outperform the others later in their lifecycle. For this reason, most investors should diversify their funds across multiple funds and even rounds. In case the portfolio manager cannot find a business that meets the criteria, allocated funds will be returned – refunded or available for the next investment round.

However, variety goes beyond the business model, as it can diversify within the category. For example, funds #8012 and #8013 focus on content monetization, but the first focuses on search engine optimization and geo-targeting, while the second focuses on growth synergies and monetization expansion.

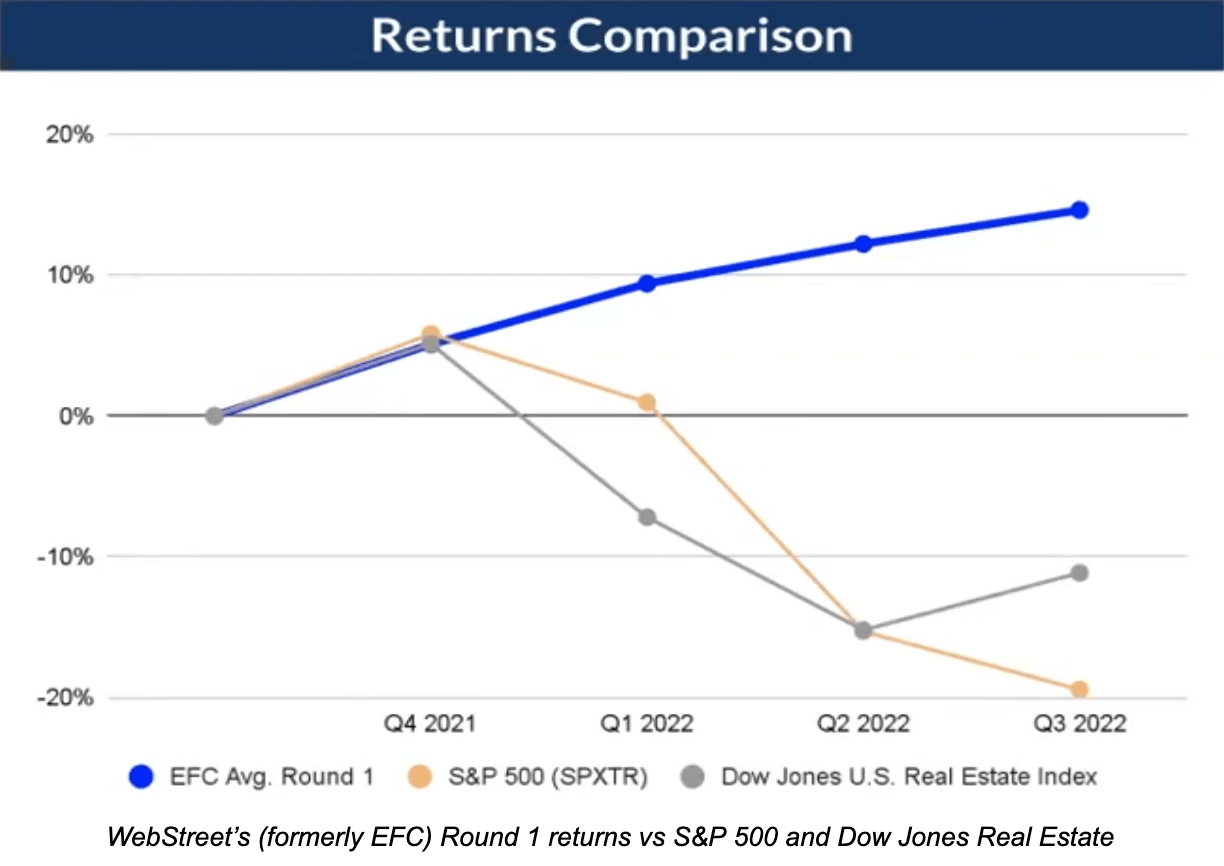

Looking deeper into Round 1, returns after four quarters are on track at 14.6%. The chart provided shows that WebStreet returns have significantly outperformed the most popular stock market benchmarks.

Similarly, Round 2 funds demonstrate resilience in the current economic environment. Although slightly slowing down (compared to 2021), their positive performance reflects prompt adjustments to market conditions, mitigating risks like supply chain issues and geopolitical events while taking advantage of consumer seasonal spending.

Meanwhile, Round 3 funds are underway, with three portfolio managers acquiring seven online businesses worth $4.4 million in total. First distributions for Q4 22 are expected to be distributed to investors in Q1 23. Although this represents a slight decline in the amount of capital deployed, that isn’t surprising given the market weakness.

Finally, Round 4 has just closed, raising close to $4 million for 3 portfolio managers. This round included three funds across these business models: Amazon FBA, Amazon Kindle Publishing (KDP), and Affiliate Display Advertising. The asset acquisition process can take up to 90 days, and if there are no suitable businesses to purchase, investors will receive their money back.

Looking Ahead to New Opportunities

With a broad range of macroeconomic and geopolitical issues like armed conflicts, energy crises, or semiconductor shortages, there are many triggers for the next potential recession. In this scenario, money managers would proclaim that cash is king and recommend sitting out through the turbulence. However, many leading economies also suffer from high inflation, diminishing the viability of staying in cash.

Still, alternative assets like online businesses have shown no correlation with many of those weakening assets.

Economic downturns create liquidity crunches, reducing buying power. But resilient investors can take advantage of this to purchase businesses at a lower valuation, increasing their relative ownership. And remember, economic downturns aren’t permanent. An average recession lasts 17 months, while an average WebStreet fund targets 36 months. Investors can profit from a market rebound on top of the added value that portfolio managers create by increasing the website’s value and receiving cash flow during this business cycle.

WebStreet is currently funding Round 5, looking to capitalize on the current market conditions. Fill out an interest form to receive an invitation to this exclusive community of investors.